Permanent departure from Malaysia. Whats near Private Retirement Scheme- PRS.

Prs Malaysia 2019 Review Should You Really Invest

The contents contained shall not be disseminated reproduced or used either in part or in.

. Select your PRS provider. 2 Select Core Conservative under Malaysia PRS Categories dropdown menu and click the Search button. Your journey to save more for your retirement with PRS begins by following these 4 simple steps.

Cost of govt pensions over the years. To ensure private sector employee and self-employed to have sufficient savings upon retirement. And the money the govt is using actually comes from the rakyats money.

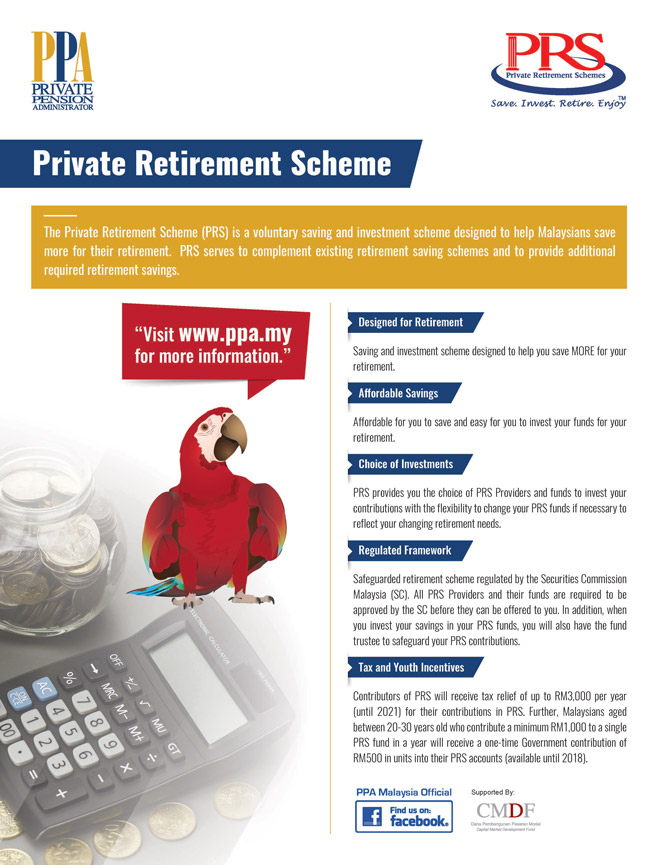

857m Allianz Malaysia - ACP Ivan Lim. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. Launched almost 10 years ago back in 2012 Private Retirement Schemes PRS in short has become another tool for Malaysians to save towards their retirement.

Now just imagine this in 2017 itself the govt set aside RM3 for civil servants salaries and pensions for every RM10 it spent. In order to ensure the welfare of retirees upon reaching retirement. The contents in this website were prepared in good faith and the Private Pension Administrator Malaysia PPA expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the information and opinion.

For example if your total annual income is RM60000 your chargeable income would be RM47000 after individual tax relief of RM9000 and an EPF tax relief of RM4000. 5 Calculate the 5-Year Annualised Average Return using the geometric average formula. You can make pre-retirement withdrawal for the following purposes without 8 tax penalty4.

3 Copy and paste the data into an Excel sheet. Behavioural psychology tells us that resisting temptation delaying gratification and staying disciplined. The Private Retirement Schemes or PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement.

KUALA LUMPUR Dec 10 Malaysians cannot afford to retire with just their EPF savings alone. October 3 2021. Address of Private Retirement Scheme- PRS submit your review or ask any question search nearby places on map.

I announced a tax relief up to RM6000 for EPF and life insurance be extended to the Private Pension Fund now known as Private Retirement Scheme. Compare the 2 actions above. See more of PRS - Private Retirement Scheme Malaysia on Facebook.

You are allowed to claim up to RM3000 for PRS contributions each year for a total of 10 years. 1809m Happy Money 168. What is PRS Introduction to Private Retirement Scheme in Malaysia skip this part if youre already familiar with PRS.

In 2014 and again in 2017 the EPF found that. Lets take a look at why you ought to consider saving for retirement with this scheme. 101 The introduction of the private retirement scheme framework was a result of recommendations made by the Securities Commission Malaysia SC to the Government to accelerate development of the private pension industry in Malaysia Private retirement.

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. There are a number of accredited PRS providers in Malaysia who are. Schemes which are an integral feature of private pension the industryseek to enhance.

On the other hand if you had invested the amount at an average rate of return of 8 pa you would have gotten returns of RM 1178040. Each PRS offers a choice. 1900m ASB Financing Unit Trust.

Beginners please read PRS or Private Retirement Scheme is another place to park and grow your retirement savings. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. With retirement planning far down the list of priorities among youths the EPF has consistently stated that a majority of Malaysians do not have enough money in their EPF accounts to last them for long.

Your chargeable income refers to your total annual income minus all the tax exemptions and tax reliefs you are entitled to. And as of recent years the govt is said to have spent almost RM28 billion for these purposes. At a rate of 3 interest pa it should give you returns of RM 656603.

Lets say you invest RM 2000 per month in a fixed deposit account for 20 years. 1106m Lika Wealth Sdn. 4 Choose Performance and extract the YTD return into the Excel sheet.

Thats the money you need when you hit 5560 years old depending on when you retire. In the 2011 Budget. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement.

Established under the Capital Markets and Services Act CMSA 2007 PRS is regulated and supervised by the Securities Commission Malaysia SC to ensure robust regulation and supervision of the PRS. If you are eligible to pay taxes you may be interested in the fact that contributions made to your PRS account can be claimed for taxes. The Private Pension Administration Malaysia PPA has commended the government for its move in extending the RM3000 tax relief for the Private Retirement Scheme PRS until 2025 stating that the extension will benefit retirement savers.

So whether you are an employer or an employee settling into the rhythms of the new norm in 2021 here are five reasons why a savings scheme like PRS should be included at the workplace. Housing purposes From sub-account B Healthcare purposes From sub-account B Permanent Total Disablement PTD Serious Disease SD Mental Disability MD From both sub-account A and B 2The age group may. Some even dont know about what PRS is all about.

If you contribute RM3000 to PRS you would pay RM240. Salary deduction to automate retirement savings. However I also realised that there are still quite a handful of people who dont make use of this today.

How To Choose The Best Private Retirement Scheme Malaysia

Pdf The Awareness Of Private Retirement Scheme And The Retirement Planning Practices Among Private Sector Employees In Malaysia

Prs Malaysia 2019 Review Should You Really Invest

Prs Malaysia 2019 Review Should You Really Invest

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

Private Retirement Scheme In Malaysia Dividend Magic

3 Reasons Why You Should Invest In Prs Private Retirement Scheme Malaysia Retirement Youtube

Prs Malaysia 2019 Review Should You Really Invest

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live

Prs Malaysia 2019 Review Should You Really Invest

Private Retirement Scheme In Malaysia Dividend Magic

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

A Guide To The Private Retirement Scheme Prs

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live

Which Prs Funds To Invest In 2020 2021 Mypf My

Deciphering The Top 10 Performing Growth Category Prs Funds I3investor

Private Retirement Scheme A Complete Guide To Prs And How I Choose The Best Fund

Best Private Retirement Schemes Malaysia 2022 Imoney My